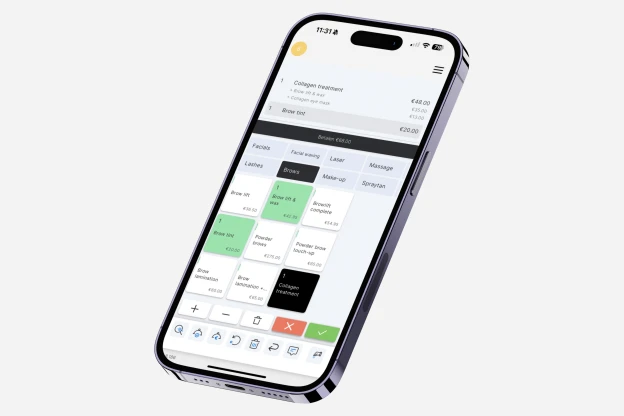

The POS system for smartphone and tablet.

The POS system for smartphone and tablet.

The payment industry is changing... Are you keeping up?

Today, as cash becomes increasingly rare, a new wave of modern payment methods is gaining ground. These include digital wallets and in-person payments, like Tap to Pay on iPhone. To keep you updated, we've highlighted several must-know trends of the payment industry.

Payment methods have evolved enormously over time. Long ago, ancient civilisations used barter systems, trading goods like wool, grains, and pottery, to process their business. Since then, monetary policies have been introduced and various trends have begun to appear and evolve. Credit and debit cards once revolutionised the payment process, but that is certainly not the end of the story.

Today, as cash becomes increasingly rare, a new wave of modern payment methods is gaining ground. These include digital wallets and in-person payments, like Tap to Pay on iPhone. Now, more than ever, customers have plenty of options when it comes to the payment process, offering unprecedented flexibility. Many industry experts believe that we're in a unique period of transformation, where consumer choices are more extensive than ever before.

This shift isn’t just beneficial for clients, new payment technologies bring flexibility to the merchants as well. Whether you run a restaurant, cafeteria, retail shop, beauty salon or any other business, you have numerous payment options at your disposal. From traditional terminals and card readers to using your own iPhone. This flexibility ensures cost cutting and high customer satisfaction thanks to the seamless and tailor-made transactions.

To keep you updated on these exciting developments, we've highlighted several must-know trends in the payment industry.

Digital wallets, mostly developed by major smartphone manufacturers, have become a primary payment choice for many consumers. Since their introduction, digital wallets have dramatically increased their market share in POS (Point-of-Sale) transactions. By 2023, they accounted for approximately 30% of all transactions, translating to 10.8 trillion dollars.

According to the 2023 Global payments report issued by Worldpay, digital wallets are leading in global POS payments and are projected to rise to 46% of all POS transactions by 2027.

This growth isn't just limited to Europe, North America, and Asia-Pacific. In regions like South America and the Middle East, where card payments have not been dominant, digital wallets are expected to gain significant traction even more rapidly.

To summarise, integrating digital wallet options into your POS is crucial for staying competitive in today’s market. Clients expect to use their preferred payment methods such as digital wallets. And with unTill Payments, you can rest assured that a huge range of digital wallets including Apple Pay, Google Pay, Samsung Pay, and PayPal are at your disposal. Guaranteeing a seamless and convenient experience for both you and your customers.

Despite the growing popularity of digital wallets and projections for their further expansion, credit and debit cards aren't disappearing anytime soon, they remain in high demand. For instance, in the Netherlands and in many other European countries, debit cards led global POS payments in 2023, accounting for 60% of all transactions. They are expected to maintain a strong presence representing around 48% of transactions by 2027.

This gradual decline in usage is inevitable, but many consumers still prefer cards for their reliability. Unlike a phone, a physical card will never ruin your purchase due to technical issues. This reliability is why many customers sometimes trust cards rather than digital wallets. Furthermore, many people, though they use digital wallets, continue to carry their cards as a fallback.

Additionally, cards are considered safe and easy to use, making them attractive to many around the world who fluctuate between using digital wallets and traditional card payments.

Setting up payment terminals requires investments of time and money for merchants. This is why the industry has been eager to find alternatives, solutions that replace the traditional terminals with something else. It turns out that the best option might already be in your hands - your iPhone. This shift towards using smartphones for payments has quickly become a hassle-free and cost-saving trend in the 21st-century payment industry.

For businesses with modern and mobile POS systems, the Tap to Pay functionality is an ideal choice that enhances and optimises a checkout process as never before. Merchants can manage orders and process payments using just their iPhones, making it a dream feature for everyone in the industry, from small retail shops to large restaurants. The convenience and ease of setup for in-person payments are highly valued across the board.

Although currently, not that many solutions offer Tap to Pay. It is clear that the future belongs to this method of payment and the best device for it is your own phone.

unTill Air, as a cutting-edge solution that always strives to provide the best and top-notch services to its clients, is set to introduce the Tap to Pay on iPhone feature in 2024.

Another money-saver for merchants is the QR code payment. This contactless method of payment simplifies the setup as it only requires finding a QR code provider, eliminating the need for terminals. Additionally, QR code speeds up the payment process, enhancing customer satisfaction because it initiates a payment and transfers the information between payer and payee almost instantly.

Notably, QR code payments are also considered very secure. Customers don’t need to physically apply their card to any hardware, instead, they simply scan the QR code generated for a particular purchase and complete the transaction directly on their own device. On top of that it also increases the autonomy of the clients during the purchasing process.

QR code payments are highly accessible, requiring nothing more than a smartphone. This makes this type of payment easy and straightforward for the clients. The simplicity and cost-effectiveness of QR code payments have made them increasingly popular. These days approximately 50% of businesses accept QR code payments, a number that is expected to continue to rise in the near future

Prepaid and gift cards are quite popular thanks to their utility for both merchants and consumers. Merchants value prepaid cards for various cases, such as offering private gift cards to loyal clients for promotional purposes or providing and accepting general reloadable cards. Consumers appreciate this to hand out or receive as a gift. This payment is widely distributed and, according to the forecast, is expected to exceed 1 trillion dollars in global transactions in 2024.

In some countries, the prevalence of prepaid cards in the payment industry is particularly notable. For instance, in Italy, thanks to the widespread use of the reloadable card providers, prepaid cards accounted for 12% of all POS transactions in 2023.

The enduring success of prepaid cards ensures that promotional gift cards and general reloadable cards will continue to thrive, undeterred by any potential inconveniences. This method remains popular and highly useful.

Try unTill Air 14 days for free - no payment details needed. Customise the app effortlessly for your business.

We’ve gathered all the information you need, so you can quickly and easily find the answers you’re looking for.

We’ve gathered all the information you need, so you can quickly and easily find the answers you’re looking for.